cash-path

What

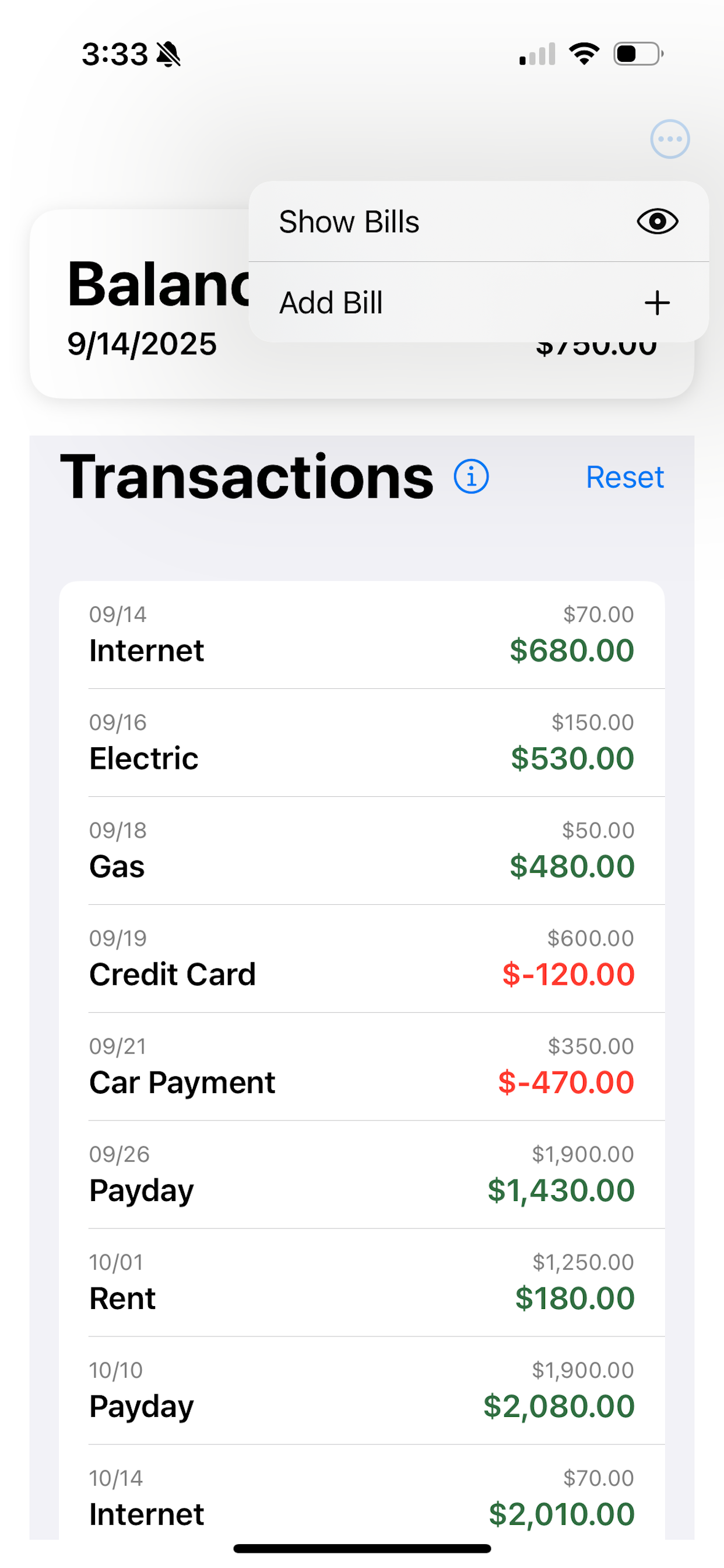

We launched cash-path, an app that shows a cash account's projected running balance. We'd love some early feedback. Check it out in TestFlight.

Why

Bank apps show current balance & past transactions.

Popular personal finance apps aggregate, budget, and report.

Neither knows if your rent/mortgage hits before your paycheck or how much your credit card payment will be.

Giving a personal finance tool access to all your banking and billing data is a privacy concern.

Who

You want to minimize your checking balance and invest the extra.

Most of your account's transactions are automatically recurring.

You know where and how much you are spending.

You avoid overdraft fees.

How

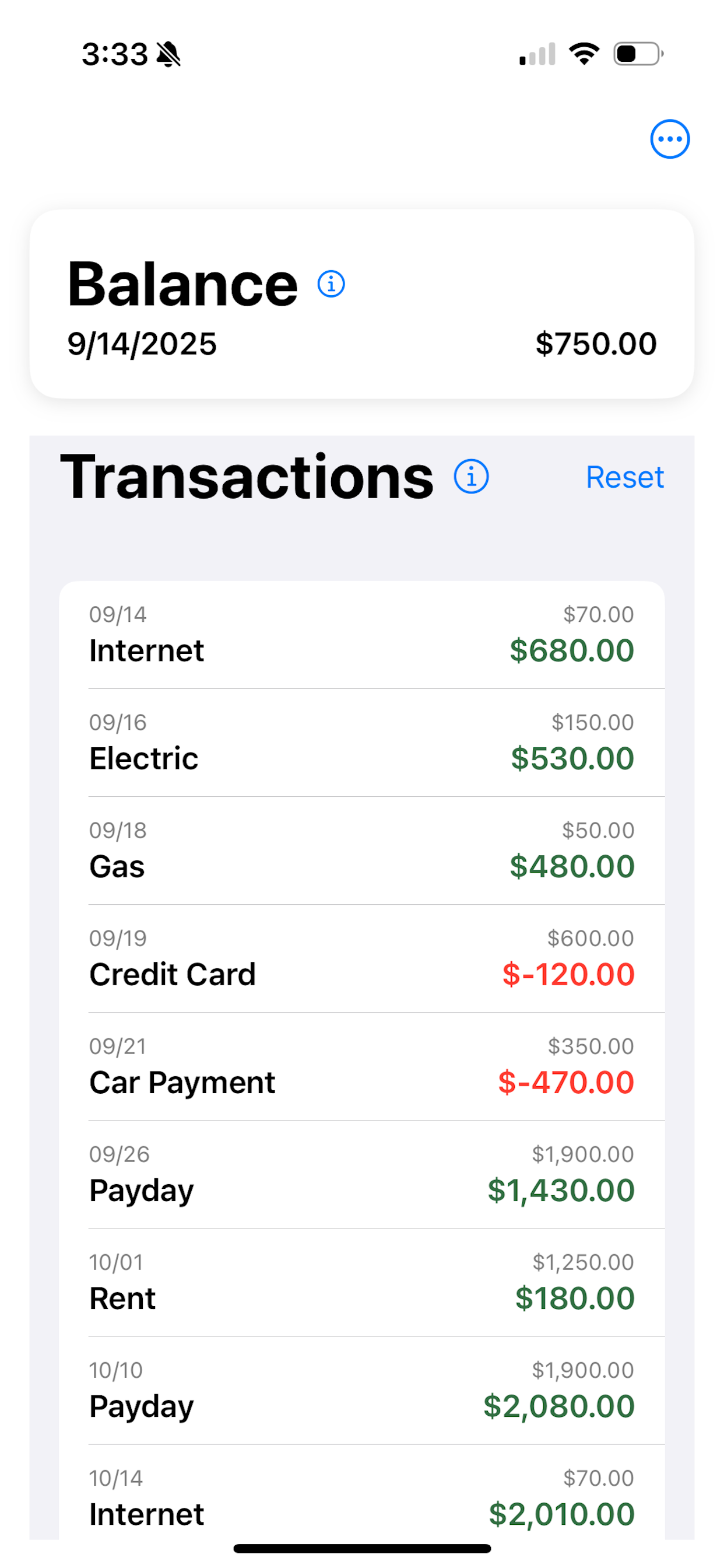

Look up your current balance and manually enter in the app.

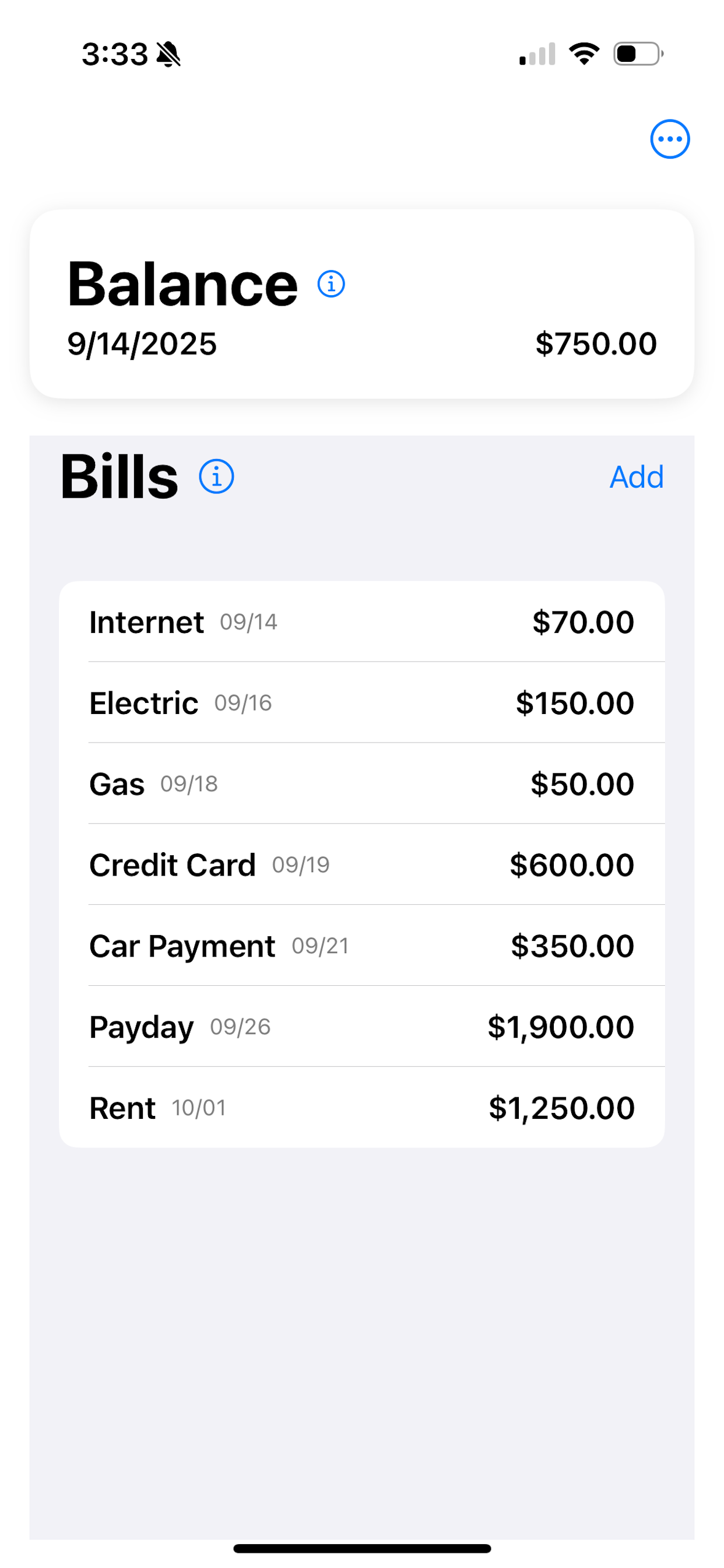

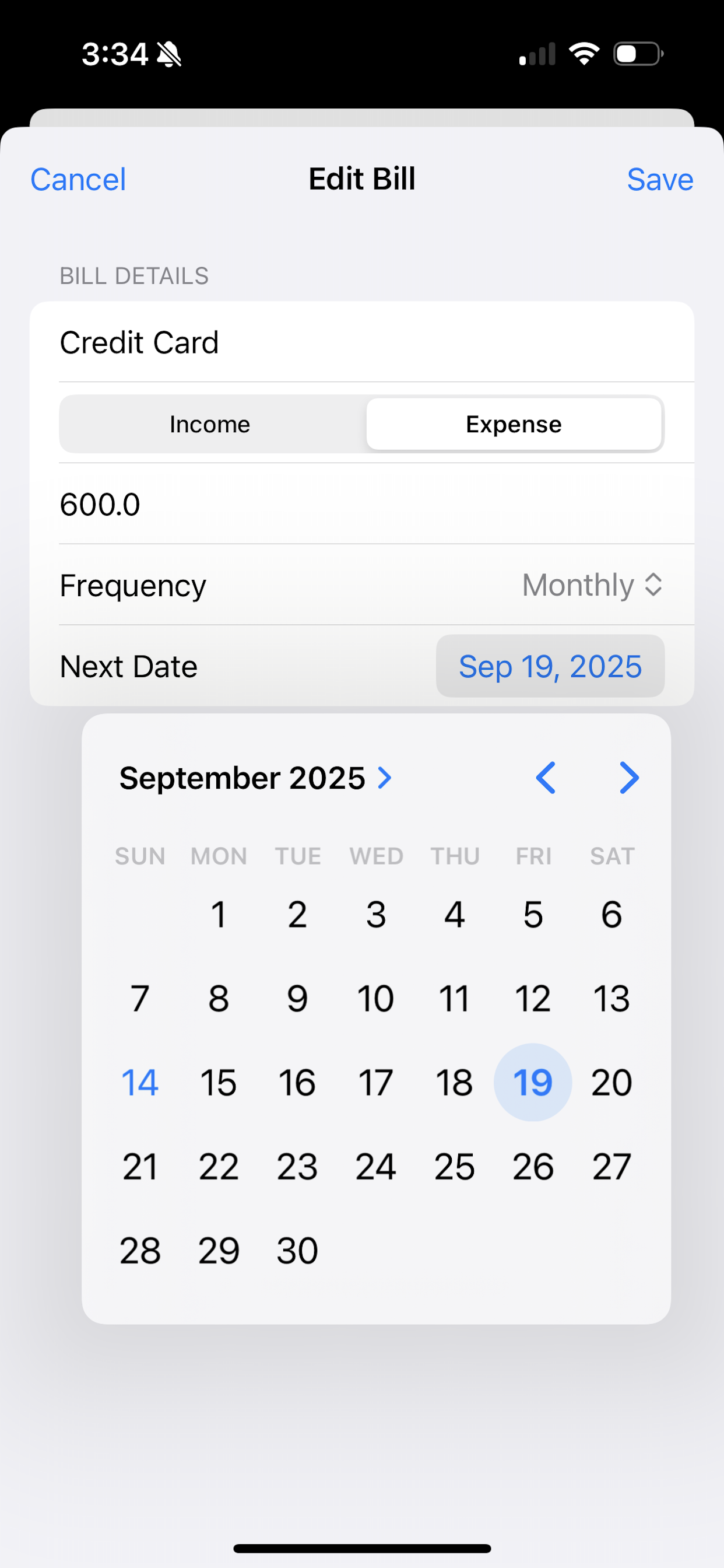

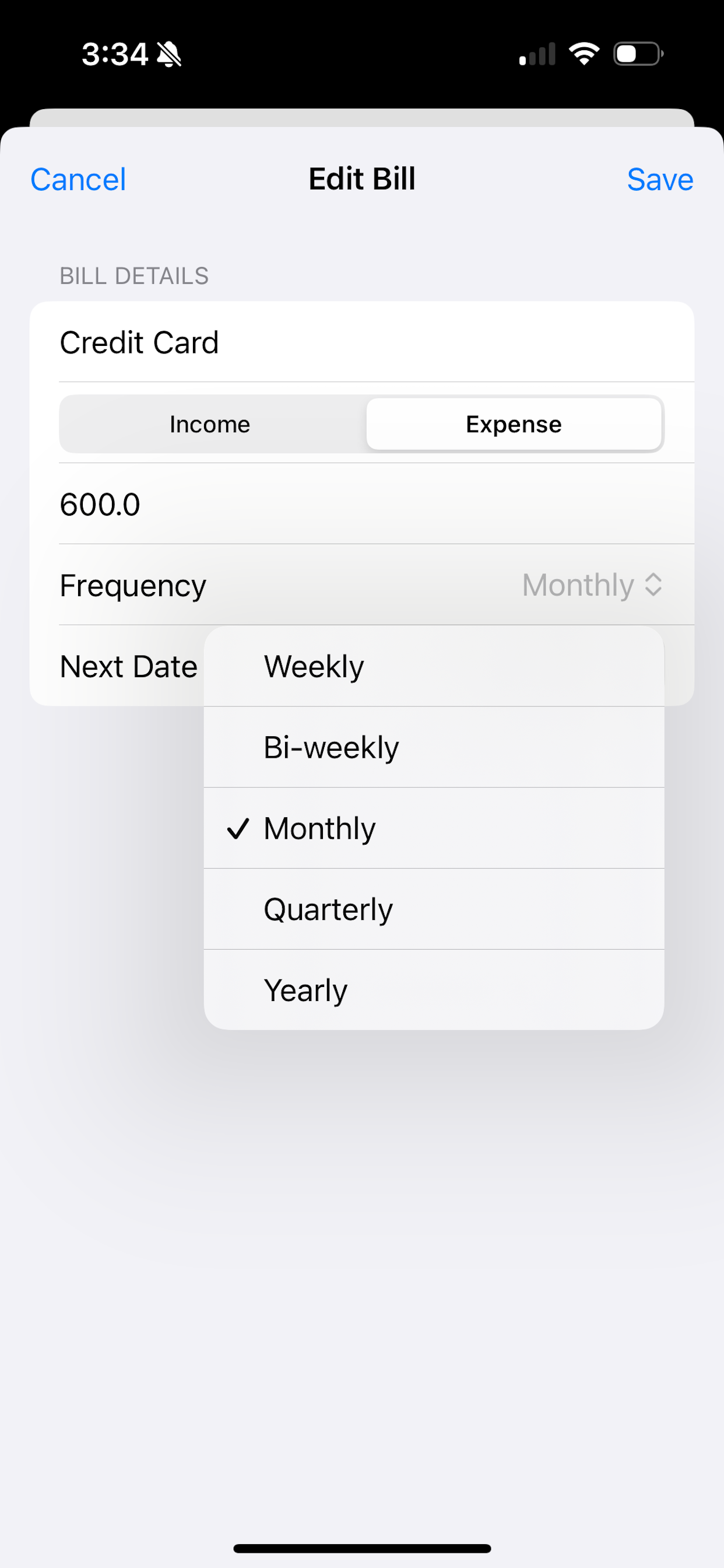

Set up your account's recurring bills: rent/mortgage, paycheck, and usual budgeted amounts for things like credit card and utilities.

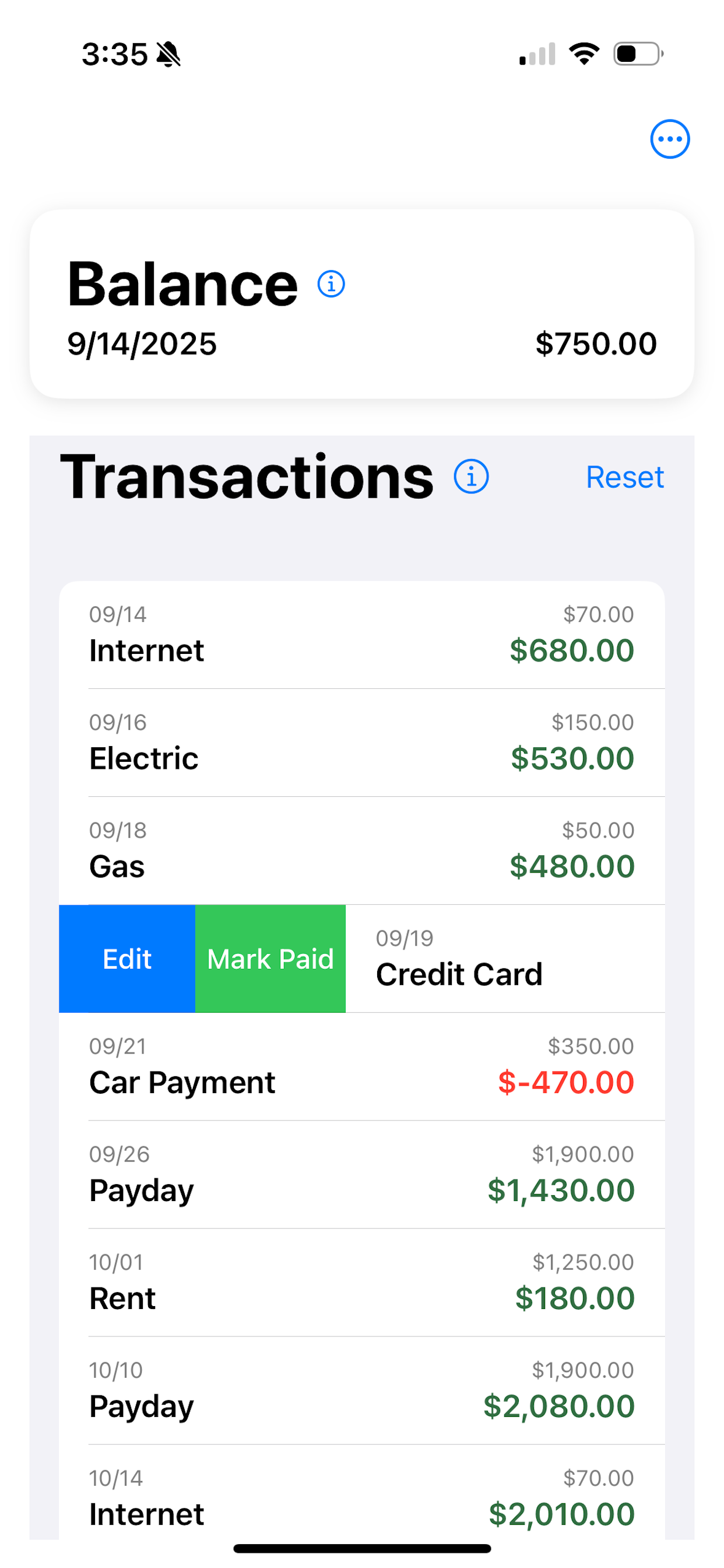

Future transactions are generated according to bill date & recurrence interval, showing the running balance.

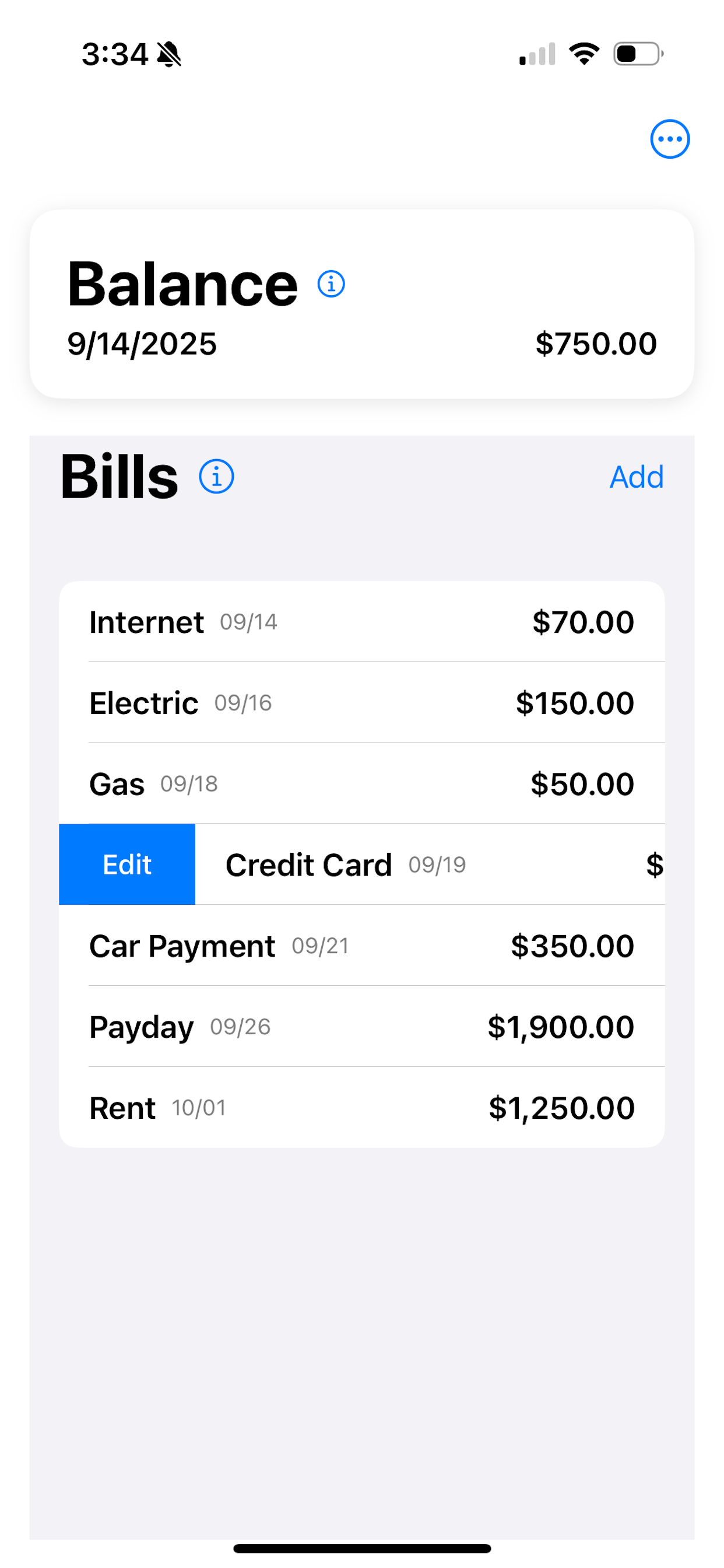

Edit transaction instances when you get the utility statement or decide how much you'll pay on the credit card.

Mark transactions as paid when they show on your banking app & are reflected in its current balance. They remain but no longer affect the running balance. Delete when no longer needed.

When

Every two weeks or so, check your banking app for balance and posted transactions. Update instance amounts based on your incoming statements.

New upcoming transactions are automatically entered.